Lagarde Says ECB to Cut Further With Inflation Close to Goal

- Economic experts pan Hochul’s ‘inflationary’ ‘inflation refunds’: ‘Not difficult math’

- Dow soars as investors welcome surprising inflation data

- Powell Says Future Cuts Would Require Fresh Inflation Progress

- What shape is Scotland’s economy in after 2024?

- Asian shares are mixed ahead of key US inflation data

(Bloomberg) — The European Central Bank will lower borrowing costs further as the inflation spike of recent years increasingly moves into the rear-view mirror, bringing the 2% target within reach, President Christine Lagarde said.

Bạn đang xem: Lagarde Says ECB to Cut Further With Inflation Close to Goal

Most Read from Bloomberg

After a “lengthy period of restrictive policy,” the accuracy of economic projections has improved and officials can concentrate on managing future risks instead of worrying about the transmission of past shocks, she said Monday in a speech, also citing evidence that still-elevated services inflation will ease in the coming months.

“Even though we are not there yet, we are close to achieving our target,” Lagarde said in a speech. “If the incoming data continue to confirm our baseline, the direction of travel is clear and we expect to lower interest rates further.”

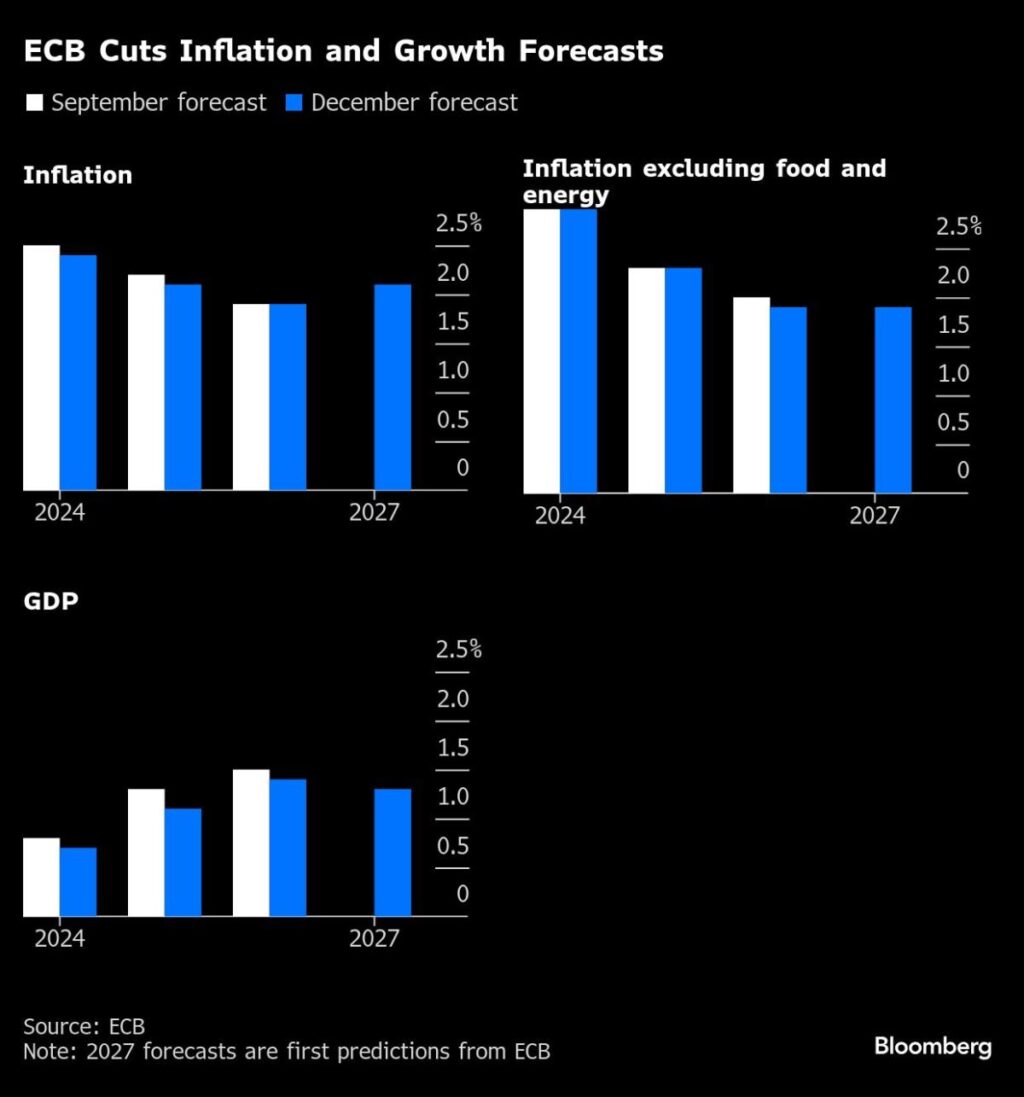

Inflation has slowed significantly from its peak and even dipped below 2% earlier this year. It’s since accelerated back above that threshold, with the ECB now expecting some fluctuation before it settles sustainably at the target.

Lagarde said domestic inflation is still too high, but that price momentum in the services sector has “dropped steeply recently.”

Xem thêm : Donald Trump Gets Bad News About His Tariff Plan From Americans in New Poll

“These data suggest that there is scope for a downward adjustment in services inflation, and thereby domestic inflation, in the coming months,” she said. An ECB tracker also sees wage growth slowing to about 3% next year — “the level we generally consider to be consistent with our target.”

Even after four cuts, the ECB reckons rates are still constricting economic activity at their current level. Most officials say policy can gradually move to a neutral setting that neither restricts nor stimulates growth. That point could be reached as soon as mid-next year, according to bets in money markets.

Officials agree that the euro-area economy is struggling, with households and firms hesitant to spend money amid high uncertainty. The ECB’s latest forecasts see growth accelerating to 1.1% next year, while conflicts around the world, Donald Trump’s re-election and political turmoil at home mean it could well turn out weaker.

While services performed better in December, S&P Global’s Composite Purchasing Managers’ Index remained at levels indicating that the euro-area’s private sector is shrinking.

Lagarde said the key reason for softer recent activity has been the lackluster domestic recovery and a “striking” inertia in private consumption.

Nguồn: https://estateplanning.baby

Danh mục: News