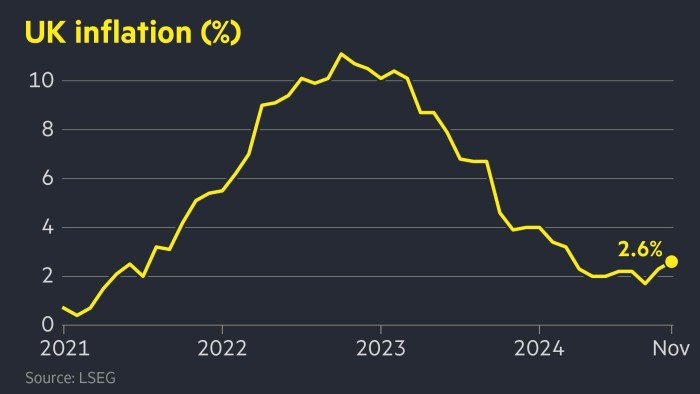

UK inflation rises to 2.6% in November

- Everyday Costs Double the Pace of Inflation, According to Ludwig Institute Report

- Nearly 90% of small businesses have been impacted by inflation

- Inflation fears driving market sell-offs is the ‘new normal’: Strategist

- Databricks nears 9.5 billion mega-investment

- Donald Trump Gets Bad News About His Tariff Plan From Americans in New Poll

Stay informed with free updates

Bạn đang xem: UK inflation rises to 2.6% in November

Simply sign up to the UK inflation myFT Digest — delivered directly to your inbox.

UK inflation accelerated to 2.6 per cent in November, highlighting the Bank of England’s challenge as it grapples with persistent price pressures and a stagnating economy.

The rise in the consumer price index was above the 2.3 per cent recorded in October but in line with expectations. Higher prices for motor fuels and clothing helped push inflation higher, according to figures from the Office for National Statistics on Wednesday.

The increase comes ahead of a meeting of the BoE’s Monetary Policy Committee on Thursday at which it is widely expected to hold interest rates at 4.75 per cent, after reducing borrowing costs twice this year.

GDP has shrunk for two consecutive months, while business surveys point to weaker confidence and curtailed hiring intentions following Rachel Reeves’ tax-raising Budget in October. But the rise in inflation and a pick-up in UK wage growth has quashed hopes of an interest rate cut at the BoE’s final meeting of the year.

Xem thêm : Index Rebounds After Encouraging Inflation Data

November’s CPI figure “extinguishes any lingering hopes of an interest rate cut on Thursday, while concerns over mounting inflation risks, including the recent spike in pay growth, mean that a February loosening is not a done deal,” said Suren Thiru, economics director at accountants’ body the ICAEW.

Following the release of the data, sterling edged down 0.1 per cent to $1.269. Investors have all but ruled out the prospect of an interest rate cut on Thursday, according to levels implied by swaps markets, and expect just two reductions next year.

Core inflation, which excludes energy, food, alcohol and tobacco, was 3.5 per cent in November, the ONS data showed, above the 3.3 per cent recorded in October.

Services inflation, closely watched by the central bank as a gauge of underlying domestic price pressures, was 5 per cent in November, matching October’s figure but below analysts’ expectations of 5.1 per cent.

Governor Andrew Bailey has said the BoE will continue to ease policy gradually but officials have pointed to the persistence of services inflation as a reason for caution.

Clare Lombardelli, the deputy governor, told the Financial Times in November she was worried that services price inflation had continued to be “well above” rates consistent with the BoE’s 2 per cent target.

Xem thêm : The Federal Reserve cut interest rates again

The November services price reading was slightly ahead of the BoE’s own 4.9 per cent forecast.

Inflation has fallen sharply from a peak of 11.1 per cent in October 2022, but the BoE now faces an uptick at a time of increasing strain for the economy. Paul Dales of Capital Economics said that he was now forecasting inflation will be nearly a point above the 2 per cent target early next year. CPI growth was just 1.7 per cent as recently as September.

Alongside signs that the Budget has had a chilling effect on companies’ hiring plans, the BoE is assessing whether the increase in national insurance contributions to be paid by companies announced by Reeves will add to inflationary pressures.

The rise in employer national insurance will be felt most acutely by services businesses given the weight of staff costs in their budgets. “This raises the question how much services inflation can decline,” warned Andrew Wishart at Berenberg bank. Historically a 3 per cent increase in services prices has been consistent with the inflation target, “which currently feels a long way off”, he added.

Mel Stride, the Conservative shadow chancellor, accused Reeves of making “a series of irresponsible and inflationary decisions” which would leave inflation higher than forecast earlier this year.

In a statement on Wednesday, Reeves said: “I know families are still struggling with the cost of living and today’s figures are a reminder that for too long the economy has not worked for working people. I am fighting to put more money in the pockets of working people.”

Nguồn: https://estateplanning.baby

Danh mục: News