<!-- HTML_TAG_START -->Powell Says Future Cuts Would Require Fresh Inflation Progress<!-- HTML_TAG_END --> <span class="caption-separator yf-8xybrv" data-svelte-h="svelte-nxhdlu">·</span> <span>Bloomberg</span>

- O’Mara: “Taxpayers deserve better than ‘Inflation Refund’ giveaway”

- Japan inflation accelerates in Nov. on reduced energy subsidies

- Economic experts pan Hochul’s ‘inflationary’ ‘inflation refunds’: ‘Not difficult math’

- WATCH: Fed Chair Powell holds news conference following quarter-point interest rate cut

- Russia struggles to tame inflation in ‘overheating’ war economy

(Bloomberg) — Federal Reserve officials lowered their benchmark interest rate for a third consecutive time, but reined in the number of cuts they expect in 2025, signaling greater caution over how quickly they can continue reducing borrowing costs.

Bạn đang xem: Powell Says Future Cuts Would Require Fresh Inflation Progress

Most Read from Bloomberg

The Federal Open Market Committee voted 11-1 on Wednesday to cut the federal funds rate to a range of 4.25%-4.5%. Cleveland Fed President Beth Hammack voted against the action, preferring to hold rates steady.

“With today’s action, we have lowered our policy rate by a full percentage point from its peak and our policy stance is now significantly less restrictive,” Fed Chair Jerome Powell told reporters in a press conference following the Fed’s decision. “We can therefore be more cautious as we consider further adjustments to our policy rate.”

Nonetheless, Powell added that interest rates were still “meaningfully” restraining economic activity, and the Fed is “on track to continue to cut.” But, he said, officials would have to see more progress on inflation before making additional rate cuts.

For Bloomberg’s TOPLive blog on the Fed decision and press conference, click here

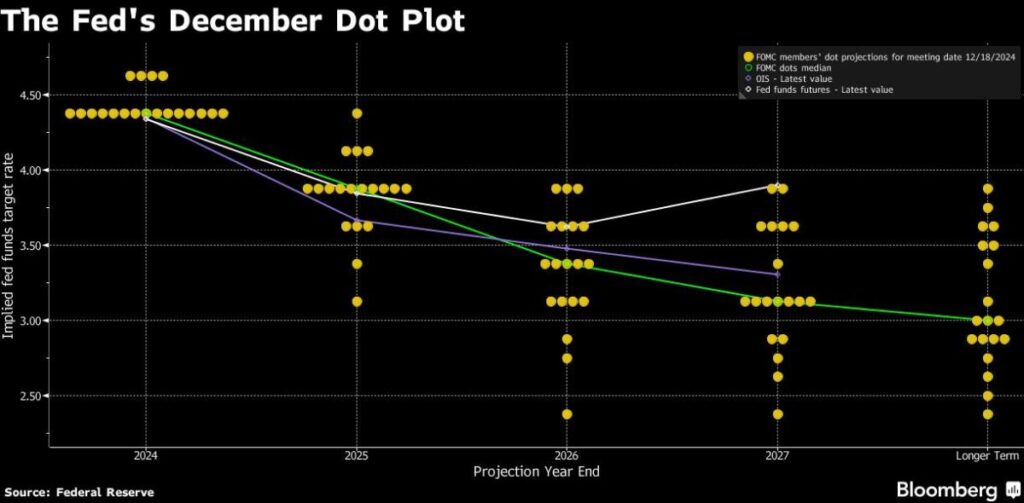

New quarterly forecasts showed several officials penciled in fewer rate cuts for next year than they estimated just a few months ago, and saw inflation making considerably less progress in 2025. They now see their benchmark rate reaching a range of 3.75% to 4% by the end of 2025, implying two quarter-percentage-point cuts, according to the median estimate.

Only five officials indicated a preference for more reductions next year.

A majority of economists in a Bloomberg survey had expected the median rate estimate would point to three cuts next year.

The S&P 500 index fell following the announcement, while US Treasury yields and the Bloomberg Dollar Index rose. The two-year note’s yield, more sensitive than longer maturities to Fed policy shifts, led the move in Treasuries, rising as much as eight basis points to 4.33%, the highest level since Nov. 25.

Xem thêm : O’Mara: “Taxpayers deserve better than ‘Inflation Refund’ giveaway”

Powell also fielded a question about how the central bank may respond to potential tariffs from the Trump administration.

The chair said some policymakers had begun to incorporate the potential impact of higher tariffs that President-elect Donald Trump may implement. But he said the impact of such policy proposals was at this point highly uncertain.

“We just don’t know, really, very much at all about the actual policies,” he said. “So it’s very premature to try to make any kind of conclusion.”

Nguồn: https://estateplanning.baby

Danh mục: News