<span class=caption>Statistics Canada released inflation data Tuesday. </span> <span class=credit>Photo by Getty Images</span>

- Inflation rates live: Bank of England expected to hold interest rates at 4.75 per cent

- Inflation Eases to 1.9%, Backing Bank of Canada’s Dovish Stance

- Trump trade aide Peter Navarro denies tariff plans will spur inflation

- November PCE: Key fed inflation gauge rose 2.4% annually

- What the latest inflation numbers mean for Bank of Canada

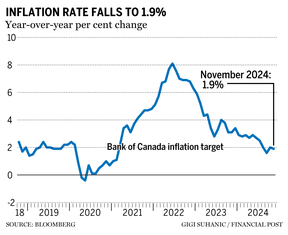

Rate has remained at or below the Bank of Canada’s target since August

Article content

Canada’s inflation rate slowed to 1.9 per cent in November, slightly below forecast and down from two per cent in October, a deceleration that economists said should give the Bank of Canada room to continue to ease its policy rate.

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

Statistics Canada said on Tuesday the November slowdown was driven by a drop in prices for all eight major components in the consumer price index basket.

Advertisement 2

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

Inflation has now remained either at or below the Bank of Canada’s two per cent target since August.

“These metrics allow the Bank of Canada to sustain its easing stance even if it starts to go in 25 (as opposed to 50) basis-point increments,” said David Rosenberg, founder and president at Rosenberg Research & Associates Inc., in a note to clients.

Shelter cost growth slowed to 4.6 per cent in November as a result of the 15th consecutive month of declining mortgage costs, while rent price growth remained strong at 7.7 per cent. Overall, shelter prices have increased by 18.9 per cent compared to three years ago.

The cost of food purchased in stores rose 2.6 per cent year-over-year in November, after rising 2.7 per cent the month before. Gasoline prices were down by 0.5 per cent, a slower deceleration than the four per cent decline the previous month.

Black Friday sales also contributed to lower prices during the month, with prices of household items dropping by 0.9 per cent. Additionally, costs of travel tours fell by 12 per cent in November.

Core inflation, the measures the Bank of Canada prefers to look at when making its monetary policy decisions, remained above the two per cent target last month. CPI-trim rose by 2.7 per cent and CPI-median came in at 2.6 per cent in November, the same as the month before. CPI-common rose by two per cent, down from 2.2 per cent reported in October.

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

Advertisement 3

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

“While the Bank of Canada will welcome the renewed dip below two per cent for headline inflation, they would prefer that the sticky core trends stayed away this holiday season,” said Douglas Porter, chief economist at the Bank of Montreal, in a note to clients. “Note that the Bank’s October monetary policy report forecast for core inflation was an average of 2.3 per cent for Q4 — instead, it’s tracking at 2.65 per cent, a notable miss.”

Year-over-year, goods inflation remained flat at zero per cent and services inflation rose by 3.5 per cent.

“November’s inflation data came in line with the Bank of Canada’s expectations for inflation to average close to two per cent over the next couple of years,” said Leslie Preston, senior economist with the Toronto Dominion Bank, in a note.

Preston added that TD is projecting that inflation will rise above the two per cent target next year as widely expected tariffs from the incoming U.S. administration raise the costs of goods.

“However, we don’t expect that this is high enough to dissuade the Bank of Canada from cutting interest rates further,” she said.

Advertisement 4

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

In his end-of-year speech on Monday, Bank of Canada governor Tiff Macklem acknowledged there are risks to the central bank’s outlooks for inflation and the economy.

Recommended from Editorial

-

Bank of Canada prepares for ‘shock-prone’ future

-

Inflation will eat away at your investing returns

“With inflation back to two per cent, we are equally concerned with inflation coming in higher or lower than expected,” he said. “The economic outlook is also clouded by a major new uncertainty — the possibility the incoming U.S. administration will impose new tariffs on Canadian exports.”

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Xem thêm : Core PCE Inflation Hits 2.8% As Interest Rate Cut Hopes Dwindle

Article content

Nguồn: https://estateplanning.baby

Danh mục: News