<span class=caption>Risks to growth are likely to be at the top of the the Bank of Canada's watchlist, economists say.</span> <span class=credit>Photo by Sean Kilpatrick/The Canadian Press files</span>

- Budgeting for inflation and the New Year – St. Olaf College

- ECB’s Christine Lagarde says ‘darkest days’ of high inflation are behind Eurozone

- Federal Reserve is expected to make 3rd consecutive rate cut this week. Here’s what to know.

- PRC infrastructure scheme drowns Laos in heavy debt, high inflation – Indo-Pacific Defense FORUM

- Britain’s bumper pay rises show inflation is tricky to shift | Economics

Central bank’s guidance for more gradual rate cuts in 2025 ‘remains intact,’ says one economist

Article content

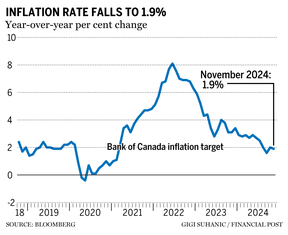

The rate of inflation slowed to 1.9 per cent in November, once again slipping under the Bank of Canada target of two per cent.

Article content

Article content

The headline consumer price index (CPI) number came in weaker than analyst expectations of two per cent, but policymakers’ preferred measures of core inflation accelerated last month more than analysts expected, according to data released by Statistics Canada on Tuesday.

Advertisement 2

Article content

The Bank of Canada on Dec. 11 said any future rate cuts would come on a meeting-by-meeting basis after it cut rates by 50 basis points.

Here’s what economists think the latest numbers mean for the Bank of Canada as it faces a fresh year of interest rate decisions starting on Jan. 29.

‘Pause in March’: Desjardins

Some of the slowdown in the rate of inflation can be attributed to Black Friday discounts, said Royce Mendes, managing director and head of macro strategy at Desjardins Group, even though food and energy prices rose, albeit at a slower pace.

“Given the seasonal element in those price declines, the Bank of Canada would typically look to its preferred core measures of inflation to guide upcoming monetary policy decisions,” he said in a note.

Those measures — CPI-median and CPI-trim — accelerated 2.6 per cent and 2.7 per cent, respectively, rather than cooling or staying flat as analysts had expected.

Xem thêm : Putin admits Russian inflation is ‘alarming’ and economy ‘overheating’

Mendes said the gains were due to the inclusion in November of mortgage interest costs, which had previously been excluded.

Mortgage interest costs have been steadily slowing since the Bank of Canada started cutting interest rates in June.

Article content

Advertisement 3

Article content

“Central bankers might want to look through that strength in their preferred measures,” Mendes said.

However, excluding shelter, the Bank of Canada’s preferred inflation measures are still coming in above the top end of its inflation target range of one per cent to three per cent.

“As a result, the Bank of Canada’s guidance for more gradual rate cuts in 2025 remains intact,” he said.

Desjardins said policymakers will cut by 25 basis points in January, but will take a break in March, with rates falling to 2.75 per cent by mid-year and 2.25 per cent by the end of 2025.

Case for a slower pace: Capital Economics

North America economist Thomas Ryan at Capital Economics Ltd. said the Bank of Canada will wave off the slowdown in headline inflation because it was mostly driven by Black Friday discounts.

“More concerningly, the above-target monthly rises in CPI-trim and CPI-median, which excluded those large (Black Friday) movements, still suggest that underlying inflationary pressures are building,” he said in a note.

Taken together, those two measures stand at 3.3 per cent annualized.

Advertisement 4

Article content

“We do not think this is enough for the (Bank of Canada) to call time on its easing cycle,” Ryan said.

But he said it helps make the case for a slower pace of decreases and raises the chances that policymakers could pause rate cuts in January, at least for that month.

Trump risk: RSM Canada

“The biggest risk to inflation lies in trade policy uncertainty that comes with the Trump administration,” Tu Nguyen, an economist at tax consultancy RSM Canada LLP, said in a note.

Xem thêm : Inflation Eases to 1.9%, Backing Bank of Canada’s Dovish Stance

Incoming United States president-elect Donald Trump has threatened to impose 25 per cent tariffs on all goods entering the U.S. from Canada and Mexico.

Economists say that poses an inflation risk because the cost of those tariffs — if there is a rebuttal — would be passed onto consumers, thereby feeding inflation and increasing the chances of fewer Bank of Canada interest rate cuts.

Policymakers will also have to consider the effect that Liberal government’s cuts to immigration targets over the next three years will have on the economy and the cost of goods and services.

“Looking ahead, it’s unclear whether the inflationary or disinflationary effects of the slowdown in immigration in 2025 will be stronger,” Nguyen said. “While it will reduce the pressure on housing, less immigration also means a lower labour supply, which could push up wages and eventually consumer prices.”

Advertisement 5

Article content

The Liberal government has cut immigration targets by roughly 20 per cent for the years 2025, 2026 and 2027.

Nguyen expects a 25-basis-point cut in January, given that “price stability is essentially restored,” with this rate-cutting cycle ending at 2.5 per cent sometime this year.

125 bps of cuts to come: Alberta Central

“Overall, nothing in today’s (consumer price index) report could suggest the (Bank of Canada) would change course and stop its easing cycle,” Charles St-Arnaud, chief economist at credit union Alberta Central, said in a note.

Headline inflation sits at the Bank of Canada’s target, so it’s likely not “the main worry” for policymakers at the moment.

Nevertheless, St-Arnaud thinks the Bank of Canada will keep an eye on the “sticky” core measures it likes to monitor even though the major tripping hazards don’t lie there.

Instead, risks to growth are more likely to be at the top of the central bank’s watchlist, with lower population growth posing “a major drag on the economy, pushing potential growth … lower” and possibly the neutral rate — the interest rate that neither boosts nor chokes growth.

Advertisement 6

Article content

Recommended from Editorial

-

The best mortgage rates in Canada right now

-

Canada’s inflation rate cools more than expected

-

Ex-Bank of Canada official sees key rate hitting 2.75 per cent

A lower neutral rate means the Bank of Canada could cut more than previously expected.

St-Arnaud still expects the Bank of Canada to cut by 25 basis points at the January meeting and is calling for this cycle to end at two per cent next year, “implying a 125-basis-point reduction over the course of the year, as long as inflation remains consistent with the (Bank of Canada’s) target.”

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Nguồn: https://estateplanning.baby

Danh mục: News