Chile Cuts Rates a Quarter Point, Warns of Inflation Risks

- The Federal Reserve cuts interest rates again : NPR

- UK inflation likely to rise again as cigarette and petrol prices tick up

- Inflation fears trump growth concerns among Bank of England’s MPC members | Bank of England

- UK inflation rises to 2.6% in November

- Fewer Interest Rate Cuts Likely In 2025 Due To Continued Inflation

(Bloomberg) — Chile’s central bank cut its key interest rate by a quarter point for the third meeting in a row as inflation forecasts remain anchored at target, while highlighting the need to be cautious about further reductions.

Bạn đang xem: Chile Cuts Rates a Quarter Point, Warns of Inflation Risks

Most Read from Bloomberg

Policymakers led by Rosanna Costa voted unanimously to lower borrowing costs to 5% late on Tuesday, as expected by 19 of 22 analysts in a Bloomberg survey. The other three forecast no change. The key rate has tumbled from 11.25% in mid-2023.

Xem thêm : Shoppers fight inflation as they prepare holiday meals

Central bankers extended their easing cycle as inflation expectations remain anchored at the 3% target in two years, but said risks to price-growth are on the upside in the short term as the peso weakens and electricity costs rise. Inflation is likely to fluctuate around 5% in the first half of next year, policymakers said.

“The balance of risks for inflation is biased to the upside in the short term, which highlights the need to be cautious,” the bank said in a statement accompanying the decision. “The board will gather information with respect to the economy to evaluate the opportunity for further rate cuts.”

Domestic activity is facing numerous headwinds — the economy of top trading partner China is weakening, while locally unemployment is high and business confidence levels are subdued.

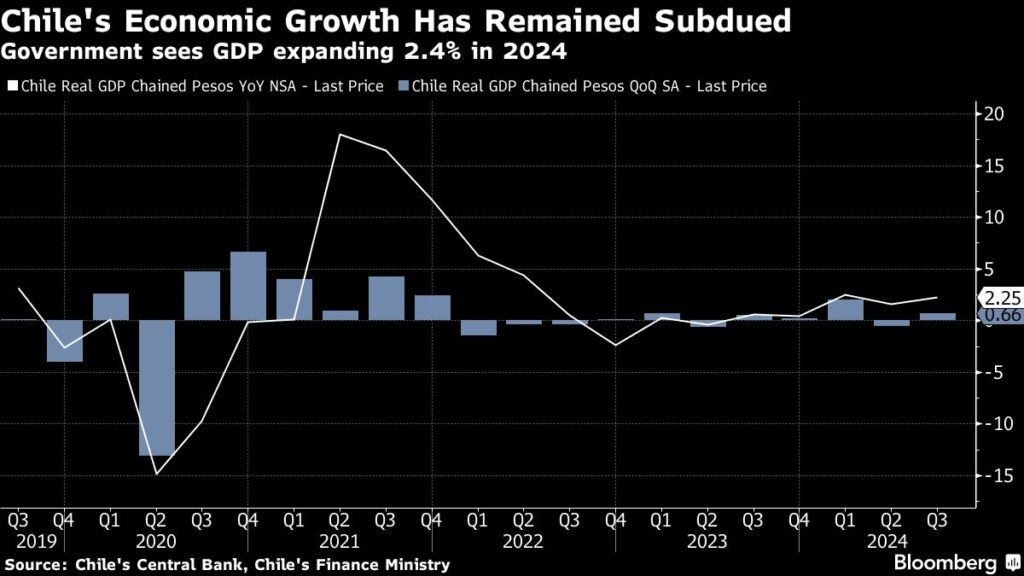

Finance Minister Mario Marcel said this month that gross domestic product will expand 2.4% in 2024, below the government’s most recent forecast of 2.6%. He singled out investment as a top challenge going forward.

Annual inflation was 4.2% in November, according to the national statistics institute. Consumer prices will remain pressured into early 2025, most notably due to another electricity tariff hike scheduled for January as well as a fresh slide in the peso, which has weakened over 11% against the dollar this year.

Xem thêm : Dow, S&P 500, Nasdaq slide as government shutdown looms, inflation data improves but still sticky

Chile’s central bank will publish its latest forecasts for economic growth and inflation, as well as the likely path for borrowing costs going forward, in its quarterly monetary policy report on Wednesday.

–With assistance from Giovanna Serafim and Rafael Gayol.

(Adds comments from policymakers starting in the first paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Nguồn: https://estateplanning.baby

Danh mục: News