Inflation and the Job Market are Sending Conflicting Signals

- Lagarde Says ECB Will Continue To Cut Interest Rates

- Fed cuts interest rates amid questions over its fight to lower inflation | Federal Reserve

- Russia Holds Interest Rates at 21% Amid Inflation

- Omaha small businesses say weather, inflation has made for slow holiday season

- Larry Kudlow reveals how to combat inflation

The U.S. economy is still growing briskly, but policymakers may soon have to manage a tradeoff between stubborn inflation and a weakening job market.

Bạn đang xem: Inflation and the Job Market are Sending Conflicting Signals

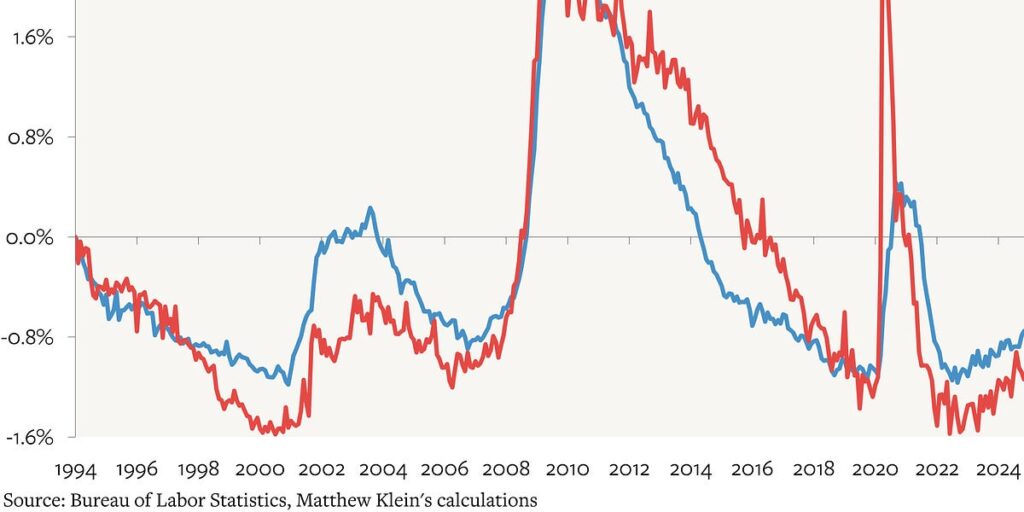

Wages and prices are still rising at yearly rates about 1-1.5 percentage points faster than before the pandemic. There has been some slowing by some measures, but others have barely budged over the past 18 months. And while employment remains high, the share of Americans aged 25-54 with a job has been dropping. Moreover, the share of workers who are unemployed because they lost a job and do not expect to be re-hired is now at its highest since November 2021.

Xem thêm : Nearly 90% of small businesses have been impacted by inflation

Federal Reserve officials may not view this as a tradeoff. Instead, they may hope that the ongoing—but, so far, modest—weakening of the job market will eventually reduce workers’ ability to secure higher pay. Since most people spend whatever extra income they earn on additional goods and services, smaller raises should eventually flow through to slower increases in the dollar value of consumer spending. If businesses keep increasing their real output of goods and services at similar rates as before, the slower growth in nominal spending should then lead to slower price increases.

From this perspective, there is no need for the Fed to do anything besides wait for this process to run its course. Fed officials have already said that the unemployment rate “under appropriate monetary policy” should continue to grind slightly higher and then stabilize over the next several years.

There are two potential challenges.

First, there is no recent precedent for the limited weakening of the job market that policymakers yearn for, although, to be fair, there is not much recent precendent for anything we have experienced over the past few years. The danger is that businesses respond to lower consumer spending not by holding off on price increases, but by cutting investment and hiring, leading to an escalating downturn far deeper than desired.

Xem thêm : Fed slows rate cuts as inflation persists

But even if the Fed avoids that, it might still fail to achieve what it wants on the inflation front. After all, job market churn has already fallen below pre-pandemic, while unemployment has already been rising for nearly two years. Yet wage growth and inflation have barely budged. Squeezing the last percentage point or so of inflation out of the system might require a more painful hit to the job market than many would be willing to accept. And this is before considering the potential impact of mass deportations and tariffs on how nominal income is split between real growth and inflation.

There is no ideal way to balance these competing priorities, but the most straightforward approach for the Fed is to hold the line on growth even if that means waiting longer (forever?) for inflation to return to the longer-run goal of 2% a year. Compared to the alternatives, this would probably be consistent with slightly higher interest rates as well as richer valuations for risk assets.

Over the summer, I argued that concerns about the deterioration of the job market were overdone. Those who panicked about the need for an emergency rate cut were focusing too much on indicators that were historically poor signals of economic conditions, while ignoring measures that were most closely tied to the cycle. Many job market market readings subsequently improved, while longer-term interest rates and risk assets both rose after the Fed lowered short-term interest rates in September.

The latest jobs numbers, for November, suggest that things may have changed. Data can be noisy month-to-month, but there are a few warning signs worth paying attention to.

Nguồn: https://estateplanning.baby

Danh mục: News