Inflation risk premium suggests higher yields ahead

- Is inflation meaningful? Is it useful?

- Inflation analysis: Prices rising faster means higher borrowing costs for longer amid recession fears

- Stocks plunge following Fed inflation projections

- Bank of England holds rates but vote split surprises markets

- Inflation rates live: Bank of England expected to hold interest rates at 4.75 per cent

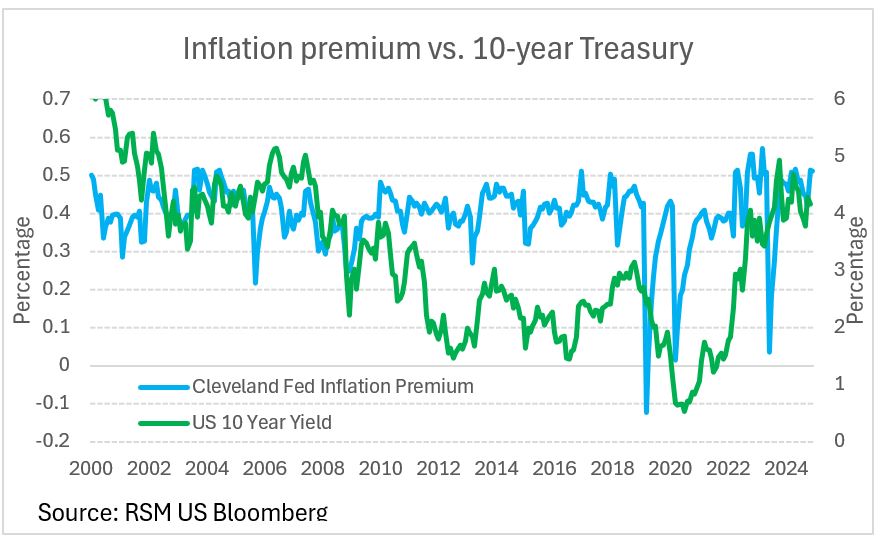

As the yield on the 10-year Treasury advances toward 4.5%—which is our baseline forecast for next year—the inflation risk premium is supporting that move.

Bạn đang xem: Inflation risk premium suggests higher yields ahead

The inflation risk premium is the compensation that investors demand for the possibility that inflation may rise, or fall, and that premium is shifting up and to the right. Should that trend continue, investors should anticipate that longer-term Treasury yields will move higher in tandem.

Xem thêm : Putin admits Russian inflation is ‘alarming’ and economy ‘overheating’

The Cleveland Federal Reserve’s measure of the inflation risk premium has moved up from 0.4175 to .05097 since late October, while the yield on the 10-year Treasury has traded between 4% and 4.5%, which implies that the risk of a move to 5% next year is increasing.

Read more of RSM’s insights on the economy and the middle market.

The last time a shift like that occurred, local and regional banks entered a period of turmoil because of the risk around their holdings of commercial real estate loans. The Federal Reserve had to step in to avoid a run on those institutions.

Now, banks could be facing a similar dynamic, which is why banks’ holdings of commercial real estate is one of the five major risks to the U.S. economy in the year ahead.

Xem thêm : Taking control of holiday spending amid inflation increase

The 10-year Treasury yield has averaged 4.19% this year and currently stands at 4.37%.

While the financial media has given a lot of attention to the Department of Government Efficiency, which has no budget or power, investors are pricing in the arrival of expansionary fiscal policy under the new administration.

Tax cuts and spending increases will most likely cause the inflation premium to rise further next year.

If one manages risk capital, makes policy or is attempting to estimate, it is better to pay attention to the signal in financial markets than the noise in the financial media.

Nguồn: https://estateplanning.baby

Danh mục: News